As an Independent Councillor focused on representing the community and supporting them during this very challenging pandemic, I am disappointed the 2020-21 council budget provides a rate increase that, while not applied immediately, will be applied at a later date.

I support the Capital Works Program 2020-21, but cannot support the rate rise. I do not support an apparent “rate freeze” in 2020 only to potentially hit residents, community groups and businesses with a double rate increase in 2021. At a time of a global pandemic and recession, of high unemployment and instability, of many businesses closing their doors and struggling to keep afloat, the council should be offering a genuine rate freeze – and perhaps a rate discount – in addition to other supports such as the Financial Hardship Policy.

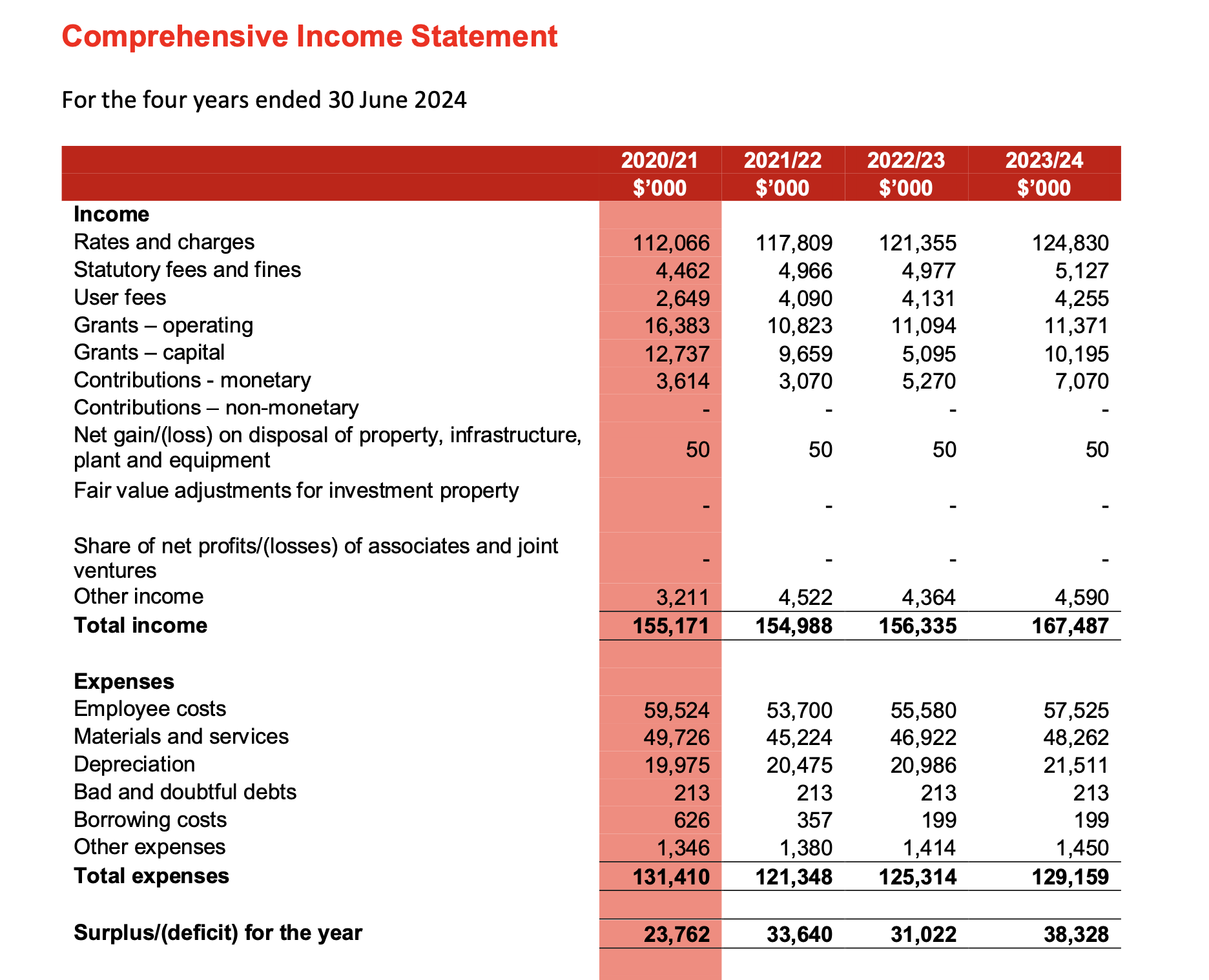

The Hobsons Bay City Council is in a good financial position. The proposed annual budget includes a surplus of $23.762 million for the year. We can afford to provide a genuine rate freeze.

I also note that many of the fees and charges have also increased, and often by more than 2%. For example, registration for a sterilised cat is going up by 4.76%, and registration for a sterilised dog is going up by 2.65%. Many of the charges to local business for street furniture is going up by around 3%. Parking ticket machines in the restaurant precinct in Williamstown are on hold for the rest of 2020, but they are going up by 5.41% when they are turned back on in 2021.

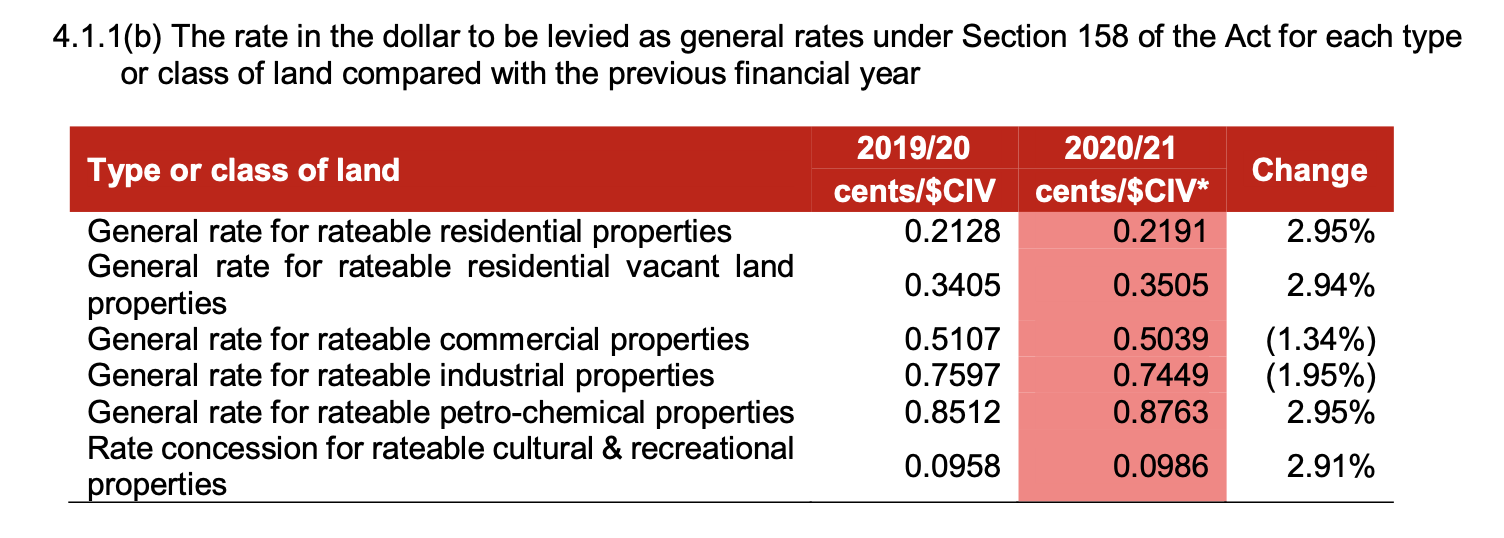

Here are some of the details extracted from the budget:

This means the actual rate increase (Capital Improved Value) for residential properties is actually increasing by 2.95% but not applied this year. It can, however, be applied in 2021 meaning ratepayers can be subjected to a double rate increase in 2021. In my opinion, a rate freeze means the Capital Improved Value should not be increased so it cannot be applied in future years. The council should completely forego any rate increase for 2020-21.

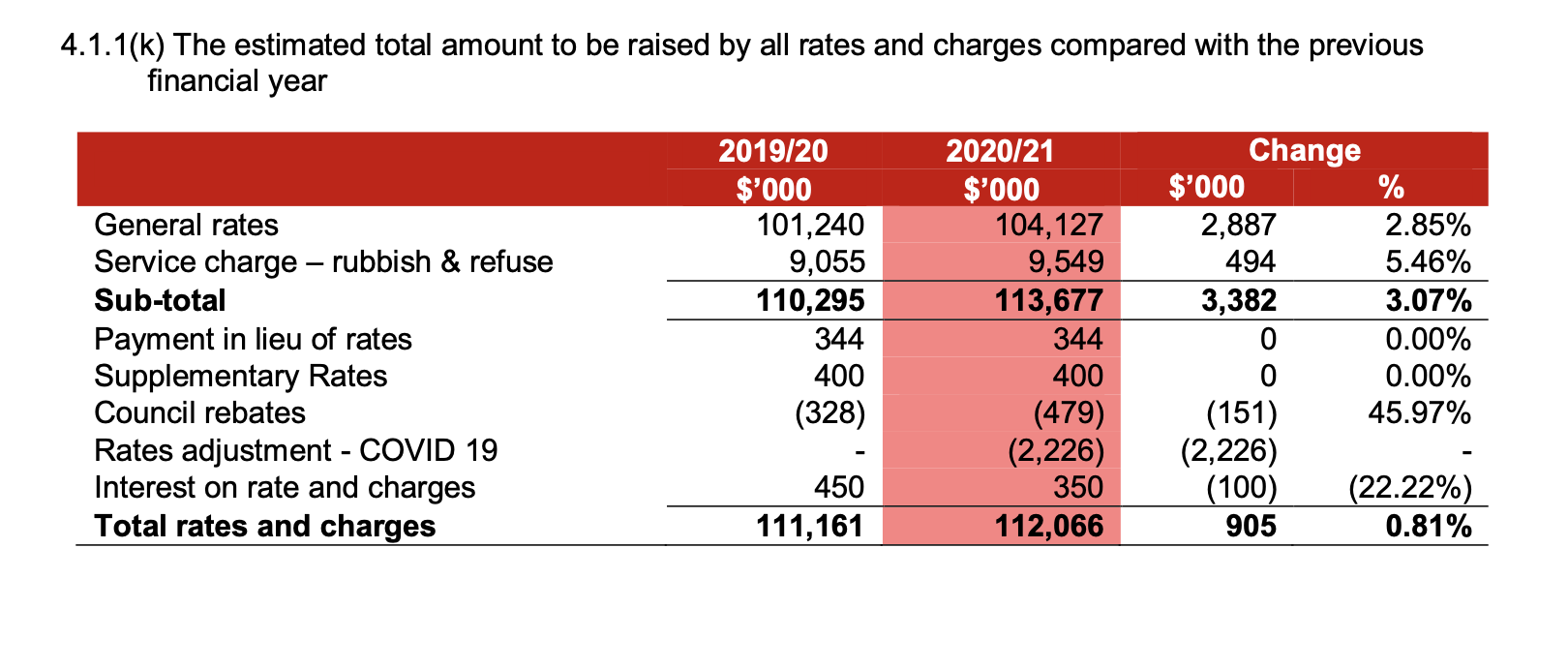

Note that the follow table from the budget shows an actual rate increase in 2020-21 is $2,887,000 and the propose rebate will cost $2,226,000. This means the council still gains $661,000 in addition to the increase in fees and charges.

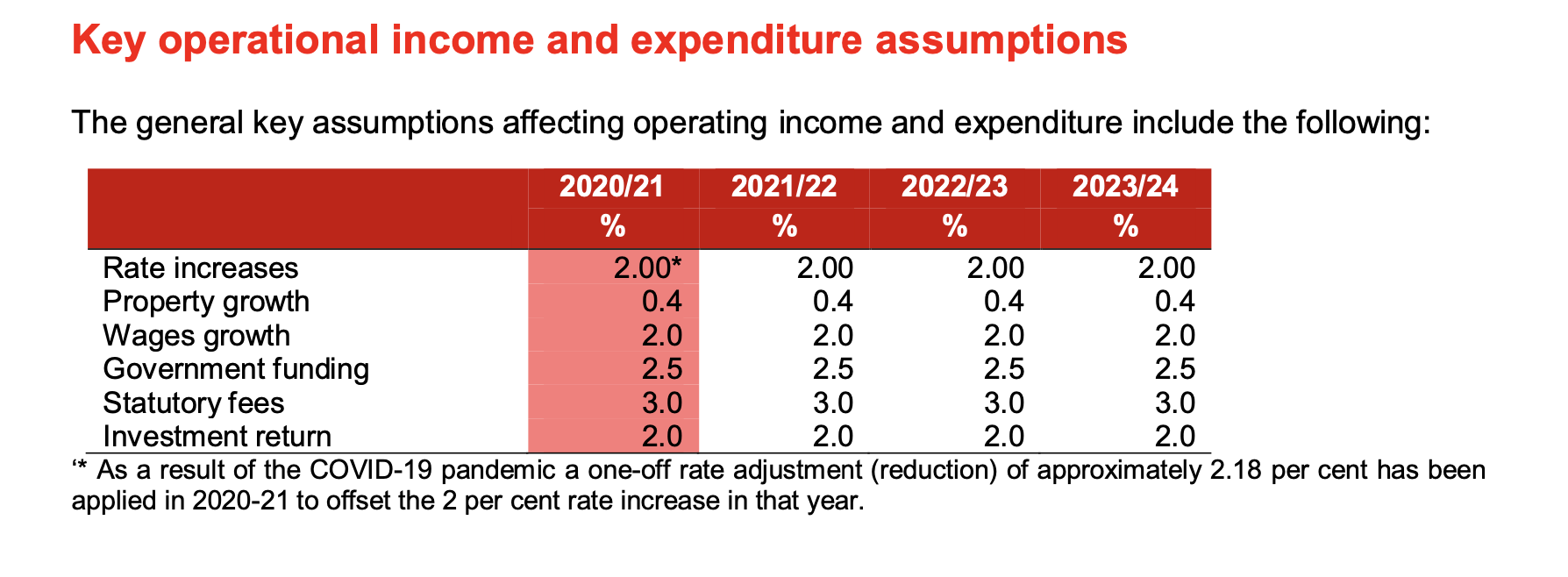

The following table from the budget clearly shows the Council administration is planning a rate increase every year of 2%, and that the rebate being applied for 2020-21 is a one off, meaning that the 2% from 2020-21 will still count in future budgets. The council budget for 2021-22 will therefore effectively have a double rate increase.

The following table from the budget shows the council is expecting significant surpluses over the next 4 years, largely from rates increasing from $112 million in 2020/21 to $124 million in 2023/24 (a 10.7% increase over 4 years!).

I urge every ratepayer (resident or business owner) experiencing financial hardship to access the new council Financial Hardship Policy. It now includes provisions for rate deferrals and waivers, and I hope it will be easy to access. Please contact the council or me directly if you want more information about that.

I also respectfully acknowledge Cr Michael Grech who also voted against the rate rise, and Cr Angela Altair who abstained from the vote.