Despite the financial difficulties many businesses are experiencing due to the pandemic, the Hobsons Bay City Council is determined to push ahead with its planned rate increase. The proposed average rate increase across Hobsons Bay is 2%, but it is 3.89% for commercial properties (e.g. shops, cafes and other small businesses) and 8.78% for Industrial properties. Rates for petrochemical properties is proposed to increase by 1.14%.

Local shops, cafes and other small businesses and local industry are really hurting, as are their staff. Increasing rates to these local businesses at this time is irresponsible and not in the spirit of council supporting local business and jobs. The pandemic has sent many to the wall, and those that survived the first lockdown and first three months until reopening are again affected by the second lockdown. Many will be lucky to survive.

The disgraced former Minister for Local Government, Adem Somyurek announced the rate cap for Victorian councils in December 2019 – well before the pandemic. Life and the Australian economic climate is very different now, and the country is in recession with negative growth. Rates should not be increasing at this time.

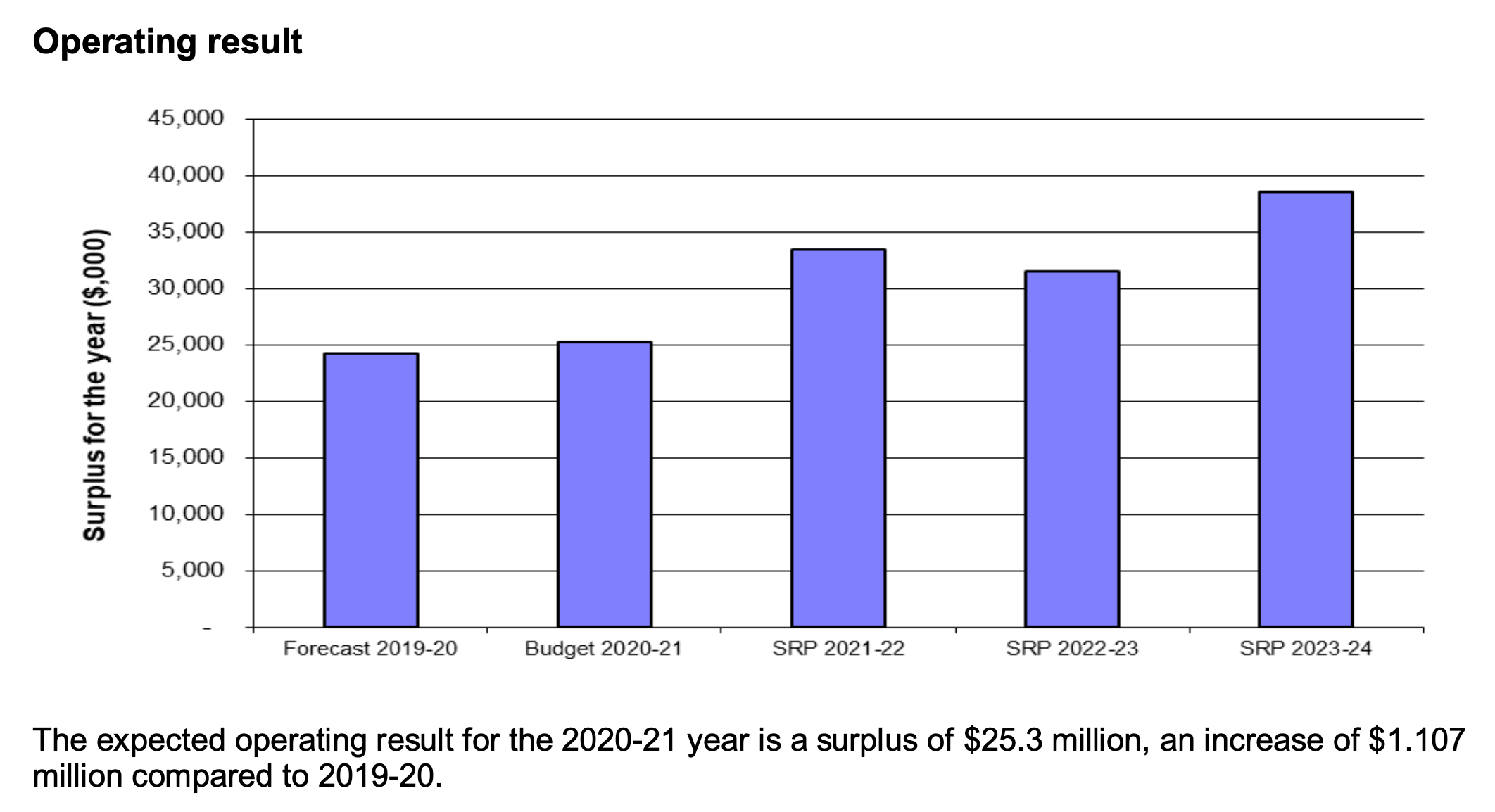

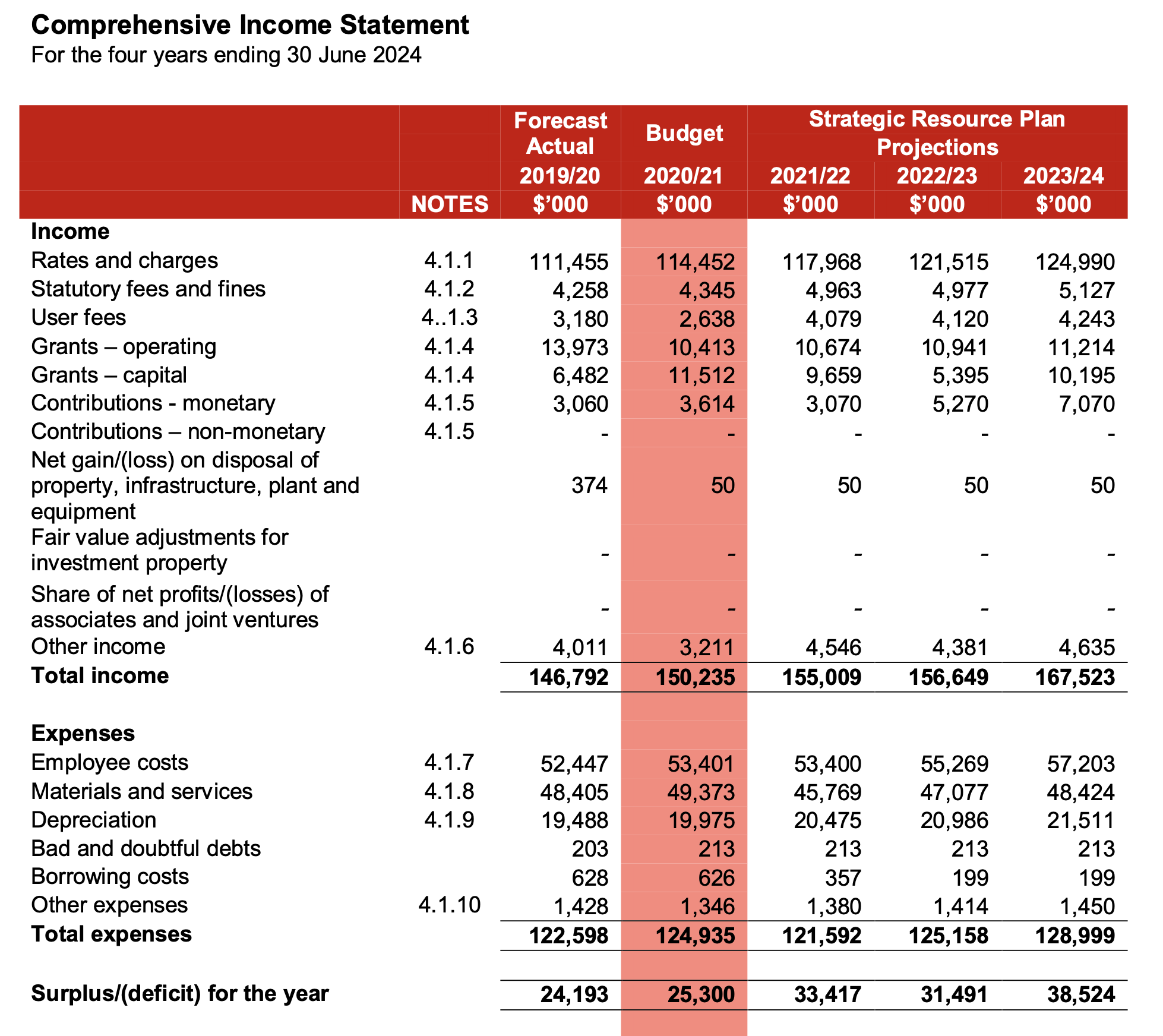

The council budget provides an operational surplus of $25.3 million for the year for 2020-21. This is a surplus increase of $1.107 million compared to 2019-20.

Whilst the average general rate increase is 2 per cent as mentioned above, total rate income is expected to increase by 2.69 per cent, due to waste service charges and supplementary growth, raising total rates and charges for 2020-21 to $114.452 million.

COVID-19 Community Support Package

The council administration will argue that the COVID-19 Community Support Package will ensure local businesses are supported during this time, and that 150% of the increase in rates will go back to the community. Let’s have a look at what this package includes:

(a) program to support local connections ($100,000);

(b) incentives to use Council venues including the Williamstown Town Hall and Altona Theatre ($132,000);

(c) waiver of summer sports ground rentals ($72,000);

(d) strategic planning support for sports clubs to resume training and competition ($60,000);

(e) sports pavilion cleaning program ($20,000);

(f) ‘loan to own’ iPads program at the libraries ($60,000);

(g) an additional $500,000 to the existing Annual Community Grants Programs (Community groups, organisations and clubs, not businesses);

(h) rebates for the 2020-21 food registration ($595,000), public health fees ($63,000), and footpath trading permit fees ($150,000);

(i) extending the waiver of paid parking in Nelson Place until 31 December 2020 (customers of businesses located at Williamstown Beach will also be provided dedicated permits for free parking during this period) ($520,000);

(j) rent relief in Council owned property ($210,000);

(j) town planning rebates ($177,000); and

(k) rolling out a business precinct support campaign ($250,000).

These arguably provide little support to traders. Waiver of paid parking fees in Williamstown, for example, reduces the income to council, but that was impacted by the pandemic anyway. Further, none of that money is going to local businesses. Commercial property owners are being required to reduct rent to tenants, so even that so called “rent relief” of $210,000 is not anything not being expected of other owners of commercial buildings and is only going to assist council’s tenants. Doing things like not charging for footpath trading permit fees and public health fees is the least the council can do to support local business.

Out of the whole $3 million support package, only a small portion is actually going to support local businesses.

Hobsons Bay Financial Hardship Policy 2020.

The council is also rightly improving its Financial Hardship Policy to enable residential ratepayers, businesses, sporting clubs and community groups to get assistance from their rates, waste charges, fees, user charges and interest in the form of a deferral, discount, waiver or refund. Only the council CEO can authorise a waiver or refund of money paid to/ or payable to Council including rates, interest, rent, fees and charges. Waivers or refunds are limited to a cumulative total value of $10,000 or of 12 months rates value, whichever is the lesser amount, for each applicant, and no more than waiver or refund application can be approved for any individual, club, association or business.

The assessment process is supposed to be simple, but Council will necessarily consider all matters in its deliberations, and may seek applicable supporting information to be provided including: company records, bank statements, financial records or assessments, employment documentation, Centrelink and/or taxation information and a Financial Counselling report.

The policy states that consideration of a waiver can only occur if all financial information has been disclosed to Council with supporting documentation as requested. Council will also require the concurrence and validation of the circumstances by a qualified financial counsellor.

As you can see, this policy necessarily requires a significant degree of oversight by the council, and a commensurate degree of work for the applicant to complete the application, provide the necessary documentation and submit themselves to a financial counselling report.

It seems to me that more local businesses will be seeking deferrals, discounts, waivers or refunds if their rates are increased by 4% at this very difficult time. In my view it would be preferable for the council NOT to increase rates and charges on local businesses, and to provide this support anyway.

As I wrote in April, if we’re all in this together, why is the council’s budget immune? Why are they not willing to take some of the pain the community is feeling? The council still expects a significant surplus despite the pandemic, and is forecasting annual growth. This is from the council budget:

What Can You Do to Help?

It is important local businesses, their staff and people who support them lodge submissions to the council explaining the impact of the pandemic and the proposed increased in rates, and the little relief provided by the support package to businesses. Mention the difficulty and challenges in applying for relief and how it’s appreciated but that as proud business owners you want to avoid having to apply for rate deferrals, reductions, waivers or refunds from the council. A rate discount – and definitely not increasing rates – is what you, your business and your staff need.

To lodge a submission:

(a) Visit https://participate.hobsonsbay.vic.gov.au/2020-21-budget. All the budget documentation is provided on this page.

(b) Prepare your budget submission explaining your situation and the importance of the council not increasing rates to businesses.

(c) Lodge your submission by 5pm, Friday 24 July 2020.

Please consider speaking in support of your submission to the council. If you are willing to do this – and I really encourage you to do this – then please mention it in your submission.

Submissions should be sent to:

Andrew McLeod

Director of Corporate Services

Hobsons Bay City Council

Email: amcleod@hobsonsbay.vic.gov.au

You can also make your submission via the above page, and I also welcome you to send me a copy of your submission – tbriffa@hobsonsbay.vic.gov.au